What is Margin Formula? & How to Calculate the Net Profit Margin with Examples?

In this article, you will learn what margin is and how to calculate profit margin using the profit margin formula.

What is Margin?

The margin is a financial term that is the difference between the service selling price and cost of production. It is also known as the ratio of profit to revenue. In other words, the margin is the difference between the cost of buying an item and the cost of selling it. For example, a 20 % margin on an item means you gain 20 % profit on selling it.

There are two types of margin, gross margin, and profit margin.

Margin Formula

The margin formula calculates net profit on the sale of goods. It is the difference between what you earned and how much you spent to earn it. It is also known as the net profit margin formula, which is

How do you Calculate the Margin?

You can calculate the margin by using net profit margin formula that is:

$$\text{Net Profit Margin}\;=\;\frac{\text{Revenue}\;-\;\text{cost}}{\text{Revenue}}$$

This formula divides the difference between revenue and the total cost by the revenue to get the net profit margin. We provide you with a step-by-step method to find profit margins.

- Find the total cost and revenue of the goods.

- Find the difference between revenue and total cost.

- Divide the difference between revenue and cost of the good by the revenue value to get a net profit margin.

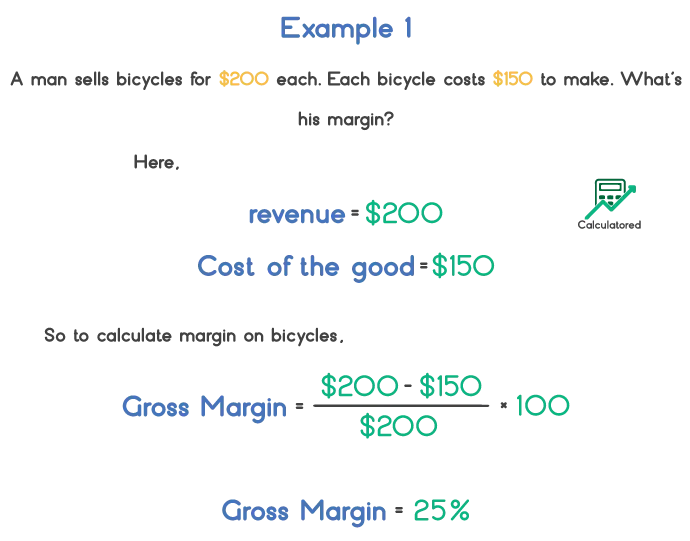

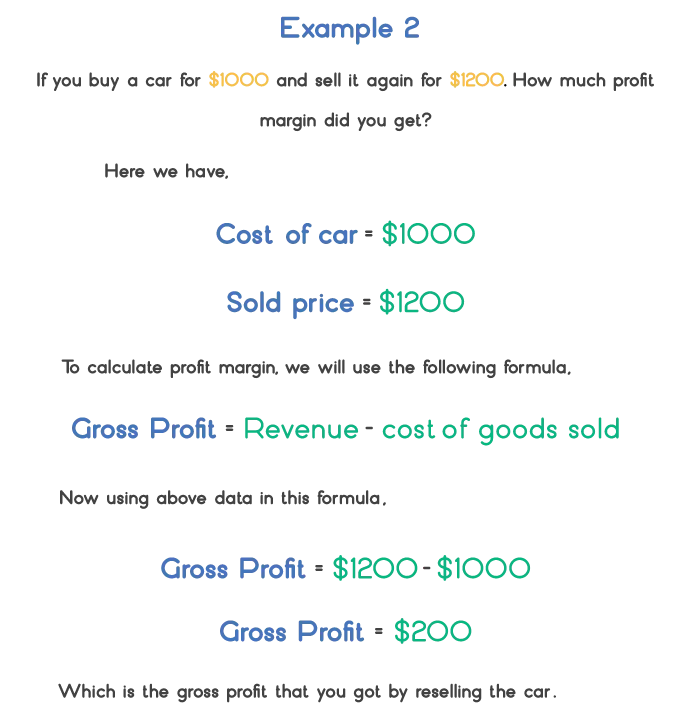

Here are some examples to understand how margin is calculated.

Related Formulas

There are three formulas that are related to expected value. These are:

- Profit Margin Formula

- Gross Profit Formula

- Gross Margin formula

The profit margin measures the profitability ratios and net profit margin, which means how much you will gain profit on any item. It can be calculated after deducting the sales tax. It is the ratio of net profit and total revenue. So the formula is:

The gross profit is the amount of profit that is calculated by deducting all types of costs associated with it. The operating profit margin formula to calculate gross profit is:

- Profit Margin Formula

- $$\text{Profit Margin}\;=\;\frac{\text{Net Profit}}{\text{Total Revenue}}$$

- Gross Profit Formula

- $$\text{Gross Profit}\;=\;\text{Revenue}\;-\;\text{cost of goods sold}$$

- Gross Margin formula

The gross margin is not the same as the gross margin. It is the percentage of the difference between the revenue and cost. It tells you what profit is gained by selling goods, including all production costs. The gross profit percentage formula to calculate gross margin is:

$$\text{Gross Margin}\;=\;\frac{\text{Revenue}\;-\;\text{cost}}{\text{Revenue}}\;×\;100$$

FAQ’s

What is Profit Margin Example?

The profit margin lets you know how much profit your business has generated for each sale of goods. For example a 20% margin means that you are getting 20% profit on the price of a good.

What is a Bad Profit Margin?

A bad profit margin shows that your business is running on a loss. When the margin value is negative, the profit margin is bad.

What’s Good Profit Margin?

A healthy profit margin to run a small business lies between 7 % to 10 %.