Return on Investment definition

As per return on investment definition, it is a metric which measures investment & profitability. When we define roi, Profit gain is the major thing which is concerned with investment.

What is ROI?

ROI stands for "Return on Investment". ROI measures the amount of return at a particular investment related to the investment costs. Calculation of ROI is simple and precise.

Return on investment is found by dividing the benefit of an investment by the cost of investment. The resulting figure is in the form of a percentage or ratio. ROI calculator above can help you with roi calculations.

Percentage Return on investment is altogether different from return on assets. For calculating internal rate of return, try return on assets calculator for free.

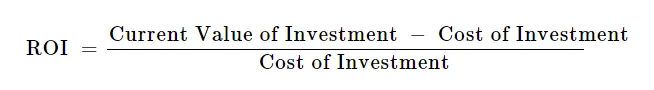

Return on Investment formula

ROI is measured over net income divided by the original capital cost of investment. If the ROI ratio is greater, the greater benefit will be earned. The ROI calculation formula is as follows:

Return on Investment formula allow us to compare different investment rates. Percentage Return on investment calculator uses same ROI formula to simplify the calculation.

ROI for Rate of Return

ROI is a broad term that can be applied to any level of assessment such as ROI on a stock investment. Percentage Return on investment is applied when a company spread the business.

It is better to consider further opportunities with higher ROI is available. Likewise, while selecting the options you should avoid negative ROI. It will impose a net loss.

The ROI helps to understand the average stock market return of invested capital. It makes the safe investments with high returns look more proper and safe.

What is ROI in business?

In roi business funding, the return on investment helps to check the rate of return of invested money. Anyhow, if you have found ROI value low you can switch to another investment option.

Large enterprises calculate ROI so that the company avoids any mega loss. They select investment option that provides the largest ROI value. It also helps a company to check total return to avoid business loss on low risk investments.